Contents:

If anyone of these two orders gets executed, the other one gets canceled as there would be nothing to sell. The first order is the limit order to sell at a higher price. Order gets executed if the price reaches $76.06 and we get $76.06 for selling 1 LTC. Think of Limit as selling for profit and Stop-limit as an order to minimize losses if it crashes. However, if you sell at market price, you might gain or loss depending on how the wind is at that moment.

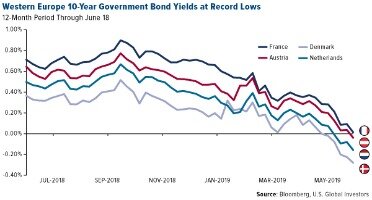

Any and all information discussed is for educational and informational purposes only and should not be considered tax, legal or investment advice. A referral to a stock or commodity the impact of inflation on bonds is not an indication to buy or sell that stock or commodity. On the secondary order window presented to you, you can add the conditions for the second order and click preview order.

How to set up a Bracket Order for a New Position (OTOCO orders)

By default, the Stop order is submitted as a Stop Limit order and uses the default “Payup” setting of “1”, which submits the child order one tick away from our Limit price. The appropriate OCO order for this market condition pairs a sell stop-loss order below the support and a stop-entry order above the resistance. OCO orders are also effective when the price of an asset seems to trade within a defined range and is poised for a breakout. This scenario is ideal after a prolonged period of consolidation wherein the price of an asset tends to surge above the resistance level or plunge below the support. Traders may prefer stop orders to be filled to avoid larger losses, but they do not necessarily prefer them to be filled over hitting a target price.

As the name suggests, when either of the triggers is hit, a limit order is placed on the exchange and the other trigger gets cancelled. Your stop loss order executes and your limit order is automatically canceled. When an OCO is entered and the orders are working in the market, a fill in the Limit order decreases the quantity of the Stop order by the filled quantity. When the Limit order is completely filled, the Stop order will be canceled. However, if the Stop order is triggered and filled, the Limit order will be canceled.

Knowing how volatile crypto assets can be, the trader can set an OCO order that pairs a stop-loss order and a sell limit order. This setup reduces risks while ensuring that the possibility of earning profits does not diminish. Many traders use OCO orders to minimise risk when entering a position.

When BNB reaches 500 BUSD, the limit order will be filled. This means the stop-limit order will be automatically canceled. This feature gives you the option of placing two limit orders simultaneously, which may come handy for taking profit and minimizing potential losses.

Stock Order Types Guide

The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero. Let’s assume Investor A owns 1,500 shares of a volatile stock with a current market price of $12. Since the investor has a goal of profiting from the shares, he or she ends up setting a target of $16 on it.

- Select the quantity of cryptocurrency that you want to trade.

- A Simple OCO order allows you to create two ‘linked’ entry orders in the same currency pair.

- However, if the Stop order is triggered and filled, the Limit order will be canceled.

- Ross Cameron’s experience with trading is not typical, nor is the experience of traders featured in testimonials.

- Think of it as 2 friends called you for a party — you haven’t decided which one to attend.

Click the Account Number pull-down to select another account if you have multiple accounts for the selected asset class. You can also apply With A Tick functionality to the child orders. This article contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). This article is intended to be used and must be used for informational purposes only.

Trading and Markets

Explore the step-by-step resources in the product user guides to sharpen your trading & risk management skills. To place an OCO orders pair, you have to chose aLimit order price and check the option OCO. A new field will appear, allowing you to set the stop price of the order pair. You can then place the orders pair by clicking onMargin Buy or Margin Sell. Please try again later or contact We apologize for the inconvenience. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services.

How do I sell with OCO?

In trading terms, they provided a way to sell at a higher price or to place a stop limit to sell if it goes below a certain price. To set this, click on the arrow beside the OCO and select OCO from the list. This will add more fields where you can place your price and quantity.

A one-cancels-the-other order is a pair of conditional orders stipulating that if one order executes, then the other order is automatically canceled. An OCO order often combines a stop order with a limit order on an automated trading platform. When either the stop or limit price is reached and the order is executed, the other order is automatically canceled. Experienced traders use OCO orders to mitigate risk and enter the market. An OCO order is a way to place two different types of orders, such as a stop order and a limit order, at the same time.

What is an OCO order?

Futures and futures options trading is speculative and is not suitable for all investors. Please read the Futures & Exchange-Traded Options Risk Disclosure Statement prior to trading futures products. You can set a default profit target % and stop-loss % for bracket orders by going to the Settings menu of the desktop trading platform.

For example, if a stock is trading in a range between $20 and $22, a trader could place an OCO order with a buy stop just above $22 and a sell stop just below $20. When the price breaks above resistance or below support, a trade is executed and the corresponding stop order is canceled. Tastytrade, Inc. (“tastytrade”) does not provide investment, tax, or legal advice. Options involve risk and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially significant losses. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. When the stock attains a price of $16, the limit order to sell the shares will be executed.

Having understood the use cases of OCO orders, it is time to learn how to execute one. Note that there is no standard procedure for implementing OCOs, as the process depends on the exchange platform you are using. Some exchanges offer a seamless user interface that provides easy-to-understand ways to set up OCOs. Such platforms allow users to select the number of order types they want to run simultaneously. Conversely, traders use stop-entry orders to initiate buy orders at a preset value above the current market price. This is suitable in periods when the asset is experiencing an uptrend.

Therefore, traders tend to incorporate several trading techniques that curtail losses while optimizing profitability. Additionally, you can select the account you wish to route the order in, as well as view the buying power effect. Below is an example of an order to buy 100 shares of SPY @ $311.50 with a close at profit order @ $315 and a stop-market to trigger @ $308. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders.

A Simple OCO order allows you to create two ‘linked’ entry orders in the same currency pair. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. 4) Tap any portion of your bracket order https://day-trading.info/ to make an adjustment or to cancel. To cancel the entire bracket order, tap Cancel Complex. Cancel Complex Order will cancel the entire bracket order. Cancel Order will only cancel the selected portion of the bracket order.

What is OCA vs OCO?

OCA orders are sometimes referred to as either-or or alternative trades. They can also be confused with one-cancels-other (OCO) orders which involve only two orders. These are all complicated transactions and some brokerage firms or online trading platforms do not offer them to clients.

When canceling a bracket order, you have the choice of canceling the profit target order, the stop-loss order, or the whole bracket order. You can quickly line up an OCO order on an existing open position (stock/ETF, single-leg option, or futures) by locating the position, right-clicking, and choosing Bracket. OTOCO orders are used when creating a bracket on a new Position. OTOCO’s allow you to open a trade and simultaneously set up a profit and a stop-loss target. Your results may differ materially from those expressed or utilized by Warrior Trading due to a number of factors. We do not track the typical results of our past or current customers.

Mutual Funds and Mutual Fund Investing – Fidelity Investments

Since this is an OCO order strategy, only one of these orders will execute. If Bitcoin is the first to fulfill the price condition, then the Bitcoin entry order will execute while the Ethereum entry will cancel. The reverse occurs in the case when the price of Ethereum falls to $1,000 before Bitcoin’s value hits the $20,000 price mark. Traders commonly set OCO orders when they have an open position.

What is OCO trading in Binance?

Intermediate. A ‘One Cancels the Other’ (OCO) order consists of a pair of orders that are created concurrently, but it is only possible for one of them to be executed. This means that as soon as one of the orders get fully or partially filled, the other one will be automatically canceled.

You can then set the stop-limit order’s limit price to 550 BUSD, so the order will likely be filled. An OCO order on Binance consists of a stop-limit order and a limit order with the same order quantity. If you cancel one of the orders, the entire OCO order pair will be canceled.

What does OCO mean in trading?

One-cancels-the-other (OCO) is a type of conditional order for a pair of orders in which the execution of one automatically cancels the other.